Gross hourly wage calculator

Usually this hourly wage is paid for the first 8 hours worked per daywithin the limit of 40 hours worked per week. This number is based on 37 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid.

Annual Income Calculator

Gross Pay Hours Hourly Wage Overtime Hours Hourly Wage 15 Commission Bonuses.

. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. A yearly salary of 28000 is 1455 per hour. If you get paid bi.

Income qnumber required This is required for the link to work. 45000 Salary Calculations example If your salary is 45000 a year youll take home 2851 every month. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

Heres how to calculate gross wages if youre an hourly or salaried employee. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. You will see the hourly wage weekly wage monthly wage and.

Guide to getting paid Our salary calculator indicates that on a 41066 salary gross income of 41066 per year you receive take home pay of 31461 a net wage of 31461. The latest budget information from April 2022 is used to. A pay period can be weekly fortnightly or monthly.

Multiply the hourly wage by the number of hours worked per week. Add your monthly pay and adjust the number of hours you work per week and our calculator tells you the exact amount you. Follow these steps to calculate gross wages.

Then multiply that number by the total number of weeks in a year 52. Yes you can use specially formatted urls to automatically apply variables and auto-calculate. Youll be able to see the gross salary taxable amount tax.

It can be used for the. Youll pay 6486 in tax 4297 in National Insurance and your yearly take-home. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

As an hourly employee calculating gross wages is a simple multiplication. Gross Pay Hourly Formula. This can be taken from his attendance or timesheet with his employer.

For example if an employee makes 25 per hour. Calculate the number of hours an employee has worked. Select one of the options below to let the wage calculator know how often one would receive this amount.

Net weekly income Hours of work per week Net hourly wage Calculation example Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Gross Annual Income of hours worked per week x.

It can be any hourly weekly. Use this calculator to find out your hourly wage. In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work.

Overtime rate which is usually one and a half applied to the regular rate and.

Hourly To Salary Calculator

Salary To Hourly Salary Converter Salary Hour Calculators

Pay Raise Calculator

Charge Out Rate Calculator Plan Projections

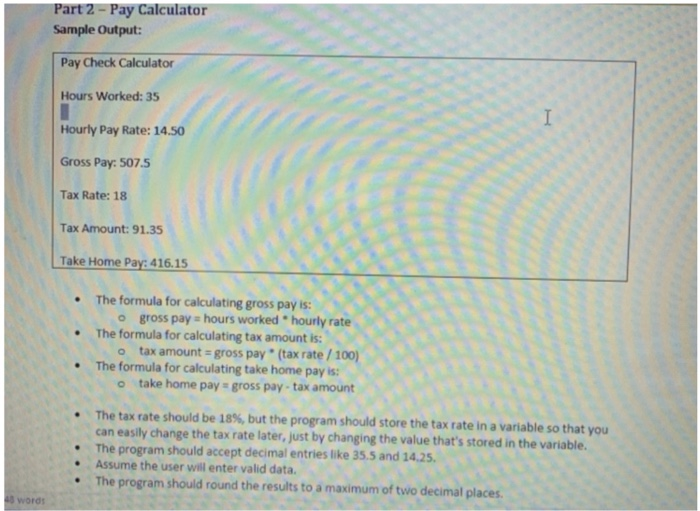

Solved Part 2 Pay Calculator Sample Output Pay Check Chegg Com

How Much Should I Charge Clients Hourly Wage Calculator Youtube

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Calculating Income Hourly Wage Youtube

How To Calculate Gross Pay Youtube

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hourly To Salary What Is My Annual Income

Avanti Gross Salary Calculator

Hourly Rate Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity

3 Ways To Calculate Your Hourly Rate Wikihow

Gross Income Formula Step By Step Calculations

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates